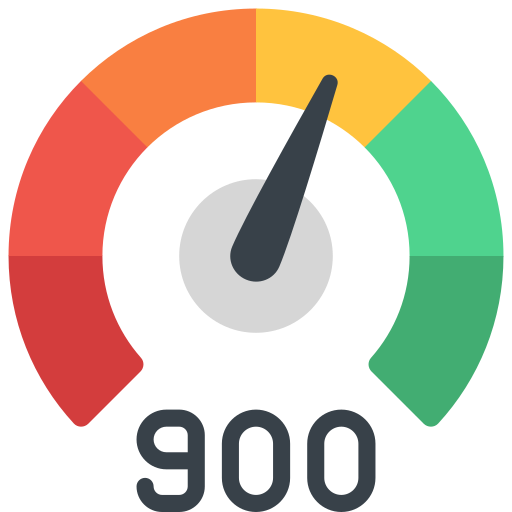

Why Should You Check Your Credit Score?

Receive a comprehensive analysis of your credit behavior. Accessing your CIBIL report won’t impact your credit score in any way.

Discover the factors influencing your credit score. Benefit from expert tips to enhance your score.

Discover thrilling loan offers customized to suit your credit score, providing personalized solutions tailored just for you.

Our Main Products

Why is it important to maintain a good Credit Score?

01

A good credit score reflects responsible financial behavior, ensuring stability during economic fluctuations.

02

Lenders offer favorable rates, reducing the cost of borrowing for mortgages, loans, and credit cards.

03

Higher chances of approval for loans, including mortgages, car loans, and personal loans, facilitating major purchases.

04

Landlords prefer tenants with good credit, increasing access to quality rental housing and favorable lease terms.

05

Utility companies may waive deposits or offer better terms to customers with good credit history.

06

Some employers check credit history as part of the hiring process, impacting job opportunities and promotions.

07

Lower insurance premiums for auto, home, and life insurance policies, resulting in significant long-term savings.

08

Maintaining a good credit score instills confidence in managing finances effectively and achieving long-term goals.

Frequently Asked Questions

Loans & Interest

Others

Business

Aaruhi Finance provides various loan options, including personal loans, home loans, vehicle loans, and business loans.

Applying for a loan with Aaruhi Finance is easy. You can either visit their website or branch office to fill out an application form.

Typically, you’ll need identification proof, address proof, income documents, and property documents (if applicable) to apply for a loan with Aaruhi Finance.

The approval and disbursement process with Aaruhi Finance is usually swift. Once your application is submitted with all necessary documents, approval can be processed within a few days, and disbursement follows soon after approval.

Loans & Interest

Business1

The interest rate on loans is affected by factors such as credit score, loan term, type of loan, and prevailing market conditions.

Depending on the lender and your creditworthiness, there may be room for negotiation on the interest rate. It’s worth discussing with your lender to see if adjustments can be made.

Generally, longer loan terms result in lower monthly payments but higher total interest paid over the life of the loan. Shorter terms typically have higher monthly payments but lower overall interest costs.

Some loans may have prepayment penalties for paying off the loan before the end of the term. It’s essential to review your loan agreement or discuss with your lender to understand any potential penalties.

Others

Business2

The interest rate for loans is determined by factors such as the borrower’s creditworthiness, prevailing market rates, loan term, and type of loan.

Fixed interest rates remain constant throughout the loan term, while variable rates fluctuate based on market conditions, potentially affecting monthly payments.

Yes, refinancing involves replacing an existing loan with a new one, often with better terms, including a lower interest rate, which can help save money over time.

Compound interest accrues on the principal loan amount and any accumulated interest, leading to a higher total repayment amount over time, especially with longer loan terms.